Let me start off by saying that I first learned about peak oil from the documentary "Collapse" starring Michael C Ruppert. The movie was a bomb that knocked me out of a stupor and awakened me to the way the world really works. It started me on an educational journey that led me to write this blog. I completely believe what is stipulated in the documentary; that the world is running out of cheap oil. Ruppert states that the easy to get oil is gone and only extremely expensive and high tech methods exist to get to the remaining oil reserves. In that scenario, only high oil prices will provide the profitability to the oil companies to continue digging. That's why companies like BP are drilling in 10,000 feet of water and not just sticking a pipe in the ground somewhere in Texas. And we know what can happen at 10,000 feet.

Many credible scientists believe peak oil is real and just as many military and financial historians proclaim that crises and war are purposefully engineered by the Establishment to drive the price of oil up, permitting greater profits for ever more expensive drilling and fracking, at greater depths at sea and in more and more dangerous locations at home and abroad. Living near an oil production site or refinery is not only dangerous for your short term health, but also dangerous for the long term prosperity of your people, your culture, your land, and your quality of life.

Look at these articles that have come out recently.

U.S. Poised To Become World's Top Oil Producer; May Soon Overtake Saudi Arabia By JONATHAN FAHEY 10/23/12 04:10 PM ET EDT, NEW YORK --

U.S. oil output is surging so fast that the United States could soon overtake Saudi Arabia as the world's biggest producer. Driven by high prices and new drilling methods, U.S. production of crude and other liquid hydrocarbons is on track to rise 7 percent this year to an average of 10.9 million barrels per day. This will be the fourth straight year of crude increases and the biggest single-year gain since 1951. The boom has surprised even the experts.

Exciting right? The "USA, the #1 Producer of Petroleum in the World" It goes on to say that the Energy Department forecasts that U.S. production of crude and other liquid hydrocarbons, which includes biofuels, will average 11.4 million barrels per day next year and that the U.S. has been increasing oil production since Obama took office. Be proud America! You've done it! You've finally gotten back your 1970's mojo. Meanwhile the rest of the world, has moved on to other energy sources, not only because it makes more financial sense, but because their lives depend on it.

Looking back at the article, the total production described is referring to all oil, liquid hydrocarbons (such as natural gas that you get from fracking), biofuels (such as the corn and hemp ethanol and biodiesel), not just petroleum. If you really want to compare apples to apples, you have to go to the source of the data. Never rely on corporate or government funded media. Never rely on private media. Just always do your own homework and make your own decisions.

Looking at the U.S. Energy Administration Department's website, we see that indeed, U.S. oil production has been rising, but after a very long decline starting in 1970.

Yet, according to this data, the U.S. has been producing just over 5 millions barrels a day since 2009, but nowhere near the 10.9 millions barrels described in the article. You see the title is misleading. It suggests that the USA is increasing its oil production above and beyond what other countries are doing, when in reality, we are not producing that much nor are other countries focused on petroleum production. They are moving to more efficient, more cost effective renewable energy sources.

Before I go any further, let me ask you 2 questions which you can answer yourself later after doing some homework.

1. What makes more sense from the perspective of the government and its constituents, to use the borrowed money with interest from the Federal Reserve or to print your own money interest free, backed by the faith and trust of the American government?

2. What makes more sense, to continue down the path set by the industrial revolution to continue using petroleum, coal, and liquid hydrocarbons pumped out of the earth from more and more dangerous corners of the earth, or generate energy from the waves, sun, wind, and plants, and heat from the earth?

Moving on. Looking at indexmundi, which source 2012 CIA World Factbook data, suggest we are close to producing 10,000,000 barrels of oil now.

So how could two U.S. government entities be working off of two different sets of data? How can the numbers differ so much?

How can the U.S. be producing more oil under a Democratic president that has given all his energy production attention in public to green technologies? This is the president who doubled fuel efficiency standards, and put a stop to the domestic pipeline project. Remember all Republicans jab Obama for not allowing drilling on public land. How could he allow oil production to rise domestically and no one noticed or even gave him praise? Why wouldn't he tote this as an achievement to help him win the election? Is he too humble or is he afraid for his life? Does he feel threatened? Watched? Under control by forces so powerful that he dare not speak of them above a whisper? No way. That's crazy. he is the President of the United States of America and the most powerful man in the world. Right?

How could the U.S. nearly double its oil production in less than 5 years in a declining economy with growing unemployment, a crippled banking, manufacturing, agricultural, energy, and housing market, a shrinking workforce, and an aging population and still be going further and further into debt each year? The only thing the U.S. has going for it is technology and defense. Oh that combines well. The last time those two were dominant in one country for too long we ended up with Hitler and the Nazis.

So why can't he convince Americans to make the economy more efficient? Even Saudi Arabia is going to 100% renewable energy.

Top Oil-Producing Country Intends to Focus '100 Percent' On Renewable EnergyPrince says move 'very good for the world' Posted: Oct 24, 2012 | By: AOL Autos Staff

Saudi Arabia, , our puppet State in the Middle East that we protect so valiantly, the land with the world's largest petroleum reserves, second only to Venezuela, is going to go to 100% renewable energy for power generation, and save its petroleum for a later day. More decisive than a democracy manipulated by private interests, a monarchy ruled by oil greedy oil tycoons is going to give up using oil for it's own consumption and move to renewable energy. Meanwhile they will continue to produce enough for us at ever so slightly higher prices every year and if we ever forget who holds the bull by the balls, they will cut us off again.

But if you believe the story and took the story for face value, you could do the math and calculate what would happen next. If the U.S. produces more oil domestically, it is sold at the WTI price, typically $10-20 lower than the $110 Brent crude price, which is what we pay for foreign oil. If we then consume 18.7 million barrels a day, we have a deficit problem. Meanwhile, the world will trade fewer and fewer barrels of oil in U.S. dollars and our currency will become more and more worthless on the international market. The next thing you know, the Federal Reserve will be the only ones buying our Treasuries, to provide the Congress with an open checkbook for its authoritarian police and war state.

Wouldn't it make sense for us to pursue a more fuel efficient economy as quickly as possible? Like Saudi Arabia, China, Germany, and other European countries. Otherwise we will run up a net import surplus that throws off our GDP calculation and counters any investment, government spending, and consumption. Our economy would slow down and be burdened with higher debt in the private and public sector. Doesn't that seem to describe where we are now, after the 2008 financial crisis? We are getting awefully close to bankrtupcy and State Capitalism of Fascism. For god's sake the Federal Reserve, a privately held central bank that has a monopoly on printing U.S. currency, is supposed to be a regulator of the banks that control it. At the same time, we somehow, magically, cannot recover from this economic recession and we become more and more desperate to accept anything and anyone whoi will just promise to get us out of this mess.

If we stick to this dinosaur model based on petroleum trading, fractional banking, and debt based fiat currency, we will not only fall behind global progress in energy and economic efficiency, we will decline as a nation. Our culture will cease to exist. We will become a nation of slaves and victims, indebted to the State and its corporate masters. We will begin to suffer the same fate as third world countries all over the world, our nation will get raped, pillaged, and plundered by outside forces.

But hey, that's life. We probably deserve it, after all the plundering we've done around the world since 1898, First Blood. Go USS Maine!

Back to oil production, according to this chart Saudi Arabia has been producing between 8 million and 10 million barrels of oil a day since 1980, with the esception of the Reagan years, when oil was cheap.

Then read this:

The last year the U.S. was the world's largest producer was 2002, after the Saudis drastically cut production because of low oil prices in the aftermath of 9/11. Since then, the Saudis and the Russians have been the world leaders. The United States will still need to import lots of oil in the years ahead. Americans use 18.7 million barrels per day. But thanks to the growth in domestic production and the improving fuel efficiency of the nation's cars and trucks, imports could fall by half by the end of the decade.

But the numbers don't match. The U.S. was nowhere near able to produce 8,000,000 barrels a day in 2002. According to the EIA data quoted above, the U.S. was producing a little over 5,000,000 at that time.

So without a doubt, the Huffington Post article above, that is releasing Associated Press content is misleading at a minimum and an outright lie in my opinion.

Could this be Obama propaganda to boost his image before the election? But if Obama wanted to appeal to Republicans, all he would have to do is share the U.S. increased oil production statistics from the EIA with the world. So that doesn't make sense.

Why would AP release an article that clearly attempts to mislead its audience? Certainly the U.S. government isn't fooled by this misinformation. Oil companies have done the studies and know exactly where the oil is and what it would cost to get out. They wouldn't buy this propaganda. So that leaves us. The sheeple in the general population.

So here we are duped by bad data and political theatrics rather than seriously working on efficiencies all across the country. As Ruppert says in the documentary, we are spending as if that oil is there, bankrupting our country driving gas guzzlers.

So Obama set out a policy to get the U.S. auto fleet to an average fuel efficiency of 54 miles per gallon by 2025. That's a good step right? The U.S. Energy department website is clearly promoting fuel efficient automobiles. So are we just ignorant to continue paying an arm and a leg for gasoline when there are cars out there that get over 100 miles per gallon?

Why do Americans continue buying gas guzzling 4x4 and luxury sedans when it is obvious that we go to war to get oil for the four horsemen? Wouldn't a knowledgeable and informed public chose a more efficient and economic solution?

It sure seems like peak oil and peak debt, boom and bust cycles, and the prices of a barrel of oil are all related.

There are of course, other ways to skin a cat and stir up high oil prices. Read this excerpt from Freedom Force International:

On June 19, 2006, Alex interviewed Greg Palast on his radio show. Greg is author of Big Oil and the Armed Madhouse. It is an excellent interview because it exposes one of the greatest myths of our time. The myth is that the United States, under the influence of the large oil companies, has invaded the Middle East to capture its vast oil reserves with the goal of lowering the price of oil to America. The reality is just the opposite. It is true that the United Sates has invaded the Middle East to capture its vast oil reserves, but the goal is, not to hold down the price of oil, but to limit its production so that the price can rise. Palast produces documents proving that the official government policy is to strengthen the oil cartel known as OPEC so it can limit production and increase profit margins. Saddam had violated OPEC production limits and had to be eliminated. The public must be made aware of these facts because, otherwise, even those Americans who are not happy with the war in the Middle East will tolerate it on the false assumption that, at least, their government is acting in their best interest.

Here is another post from the most excellent site Zerohedge with another angle explaining peak oil. Pay attention to EROEI.

Guest Post: Why Energy May Be Abundant But Not Cheap

Submitted by Tyler Durden on 10/29/2012 17:41 -0400

Submitted by Charles Hugh-Smith of OfTwoMinds blog,

It doesn’t matter how abundant liquid fossil fuels might be; it’s their cost that impacts the economy.

Many people think “peak oil” is about the world is “running out of oil."

Actually, “peak oil” is about the world running out of cheap, easy-to-get oil. That means fossil fuels might be abundant (supply exceeds demand) for a time but still remain expensive.

The abundance or scarcity of energy is only one factor in its price. As the cost of extraction, transport, refining, and taxes rise, so does the “cost basis” or the total cost of production from the field to the pump. Anyone selling oil below its cost basis will lose money and go out of business.

We are trained to expect that anything that is abundant will be cheap, but energy is a special case: it can be abundant but costly, because it’s become costly to produce.

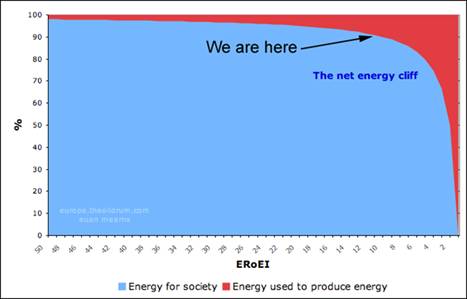

EROEI (energy returned on energy invested) helps illuminate this point. In the good old days, one barrel of oil invested might yield 100 barrels of oil extracted and refined for delivery. Now it takes one barrel of oil to extract and refine 5 barrels of oil, or perhaps as little as 3 barrels of unconventional or deep sea oil.

In the old days, oil would shoot out of the ground once a hole was drilled down to the deposit. All the easy-to-find, easy-to-get oil has been consumed; now even Saudi Arabia must pump millions of gallons of water into its wells to push the oil up out of the ground. Recent discoveries of oil are in costly locales deep offshore or in extreme conditions. It takes billions of dollars to erect the platforms and wells to reach the oil, so the cost basis of this new oil is high.

It doesn’t matter how abundant liquid fossil fuels might be; it’s their cost that impacts the economy. High energy costs mean households must spend more of their income on energy, leaving less for savings and consumption. High energy costs act as a hidden “tax” on the economy, raising the price of everything that uses energy.

As household incomes drop and vehicles become more efficient, demand for gasoline declines. Normally, we would expect lower demand to lead to lower prices. But since the production costs of oil have risen, there is a “floor” for the price of gasoline. As EROEI drops, the price floor rises, regardless of demand.

This decrease in real incomes and ratcheting-higher energy costs could lead to a situation where energy is abundant but few can afford to buy much of it.

The relative abundance of fracked natural gas and low-energy density fossil fuels like tar sands and shale has led to a media frenzy that confuses abundance with low cost. This article (via correspondent Steve K.) illustrates the tone and breezy selection of data to back up the "no worries, Mate" forecast of abundant cheap liquid fuels: An economy awash in oil. (MacLeans)

Not so fast, reports Rex Weyler of the Deep Green Blog. Here is Rex's response to the above article.

Fair point about the volume of unconventional – deepwater, shale gas & oil, tar sands, etc. – hydrocarbons. These reserves may even produce peakies and/or sustain the plateau longer than some observers believe. However, biophysical restraints remain real; peak oil remains real; peak net energy appears imminent, and the impact on economies is already being felt globally. Points to consider:The dregs: In spite of huge shale & tar reserve discoveries, peak discoveries remain well behind us, in the 1960s. My father, a petroleum geologist his entire life (and still, in Houston, Kazakstan...), knew about shale and tar deposits when I was a teenager in the 1960s. He called them "the dregs." These deposits are not really news within the oil industry. And they are the dregs because of high cost, low EROI and rapid depletion.EROI: The volume of these low-net-energy reserves could extend peak oil production for decades, but at fast-declining net energy returned to society. We high-graded Earth’s hydrocarbons, just as we high-graded the forests, fish, copper, tin, water, and so forth. We’ve taken the best, highest EROI hydrocarbons, the 100:1 free-flowing wells of the 1930s and 40s. We’re now into the 3:1 and 2:1 tar sands.For example: damming rivers in Northern BC, to send electricity to the fracking fields, to send shale gas to Alberta, to cook the boreal substrate, and mix the black sludge with gas condensate shipped in from California and by pipeline from Kitimat to Fort McMurray, to mix with the bitumen, to pipe to Vancouver Harbour, to ship to China, to burn in a power plant, to supply electricity to their manufacturing empire.By the time any of this energy gets used to actually make something useful to someone in society, and by the time that user puts that usefulness to work to feed, clothe, house, or heal anyone, there is no net-energy left.Our food in North America is already negative net energy by1:10 at best, up to 1:17 or worse for much of the crap we eat. This matters. EROI at well-head, EROI at the consumer pump, and EROI at the point of society’s actual service all matter.Well-head EROI, counting all public subsidies, is now in the 5:1 to 1:1 range for all these “non-conventional” (meaning the dregs) hydrocarbon deposits. Money can be made. Some energy can be delivered to Society, but this is already way below the well-head EROI that could likely run the current complexity of the human society, much less “grow” economies.The degrading reserves take us down along the EROI curve, in which Net Energy returned to society falls off a cliff around 6:1, and is in freefall by 3:1. Net-energy alone kills the idea of much economic growth from a booming hydrocarbon bonanza (other than some great stock plays along the way). Furthermore, depletion renders the idea ever more unlikely:Depletion: Depletion rates on these gas fields have arrived quickly and appear drastic by historic industry standards. The fracking fields peak early and decline swiftly. In the Bakken shale field – one of the great North American saviour fields – the average well has produced ~ 85k barrels in its first year and then declined at about 40% per year. The newer average wells peak earlier and decline faster, so the overall trend is down.The depletion moves the production process along a function that approaches zero net energy... Down we go along the EROI curve... 5:1 .. 4:1 .. 3 .. 2 ... and then really complex society breaks down. An Amish farmer gets 10:1.The Bakken break-even oil price is $85, so there is no profit in any of this right now, but of course there will be if global depletion exceeds demand from crashing economies.Depletion – both in volume and quality – and depletion for all industrial materials and energy stores, EROI, and economic stagnation all work as feedback loops. No one knows the bifurcation points in this complex system. We try to predict those, but miss by a longshot sometimes. Complex societies crash in this manner, declining returns on investments in complexity, from Babylon to London and Washington. See J. Tainter, H. Odum, N. Georgescu-Roegen, Hall, Cleveland, et al.Here are some depletion data on The Oil Drum: Is Shale Oil Production from Bakken Headed for a Run with “The Red Queen”?.See A Review of the Past and Current State of EROI Data (PDF) by Hall, Cleveland, et al. (source: www.mdpi.com)There is a lot of EROI data here: Obstacles Facing US Wind Energy. (The Oil Drum)Below is the EROI curve, only the “We are here” point at 10:1 is the modern average, and from a few years ago. The new conventional stuff is coming in lower and and the enhanced recovery, shale and tar fields are already over the falls at 6 or 5:1 for the better stuff (best dregs), and 3:1 to 1:1 for the dregs of the dregs, the deeper shale and tar sands.So yes, our friends are correct about the great volume of tar, shale, deep, heavy hydrocarbons, but increasing production of world liquid hydrocarbons much beyond the current 85mb/d is not likely, and increasing net productionis even less likely. As you may know, net production per capita peaked in 1979. Actual net production is peaking now. This is the figure that counts: Actual current Net Production Delivered to Society.Growing this figure is technically possible, and may happen with some massive production bonanzas, i.e. we may see actual production push above 90mb/day, or higher, and may even see net production increase, but a major glut of hydrocarbons? No. Not remotely.When settlers first came to North America, they found copper nuggets the size of horses exposed in river beds. China just bought the best known, last, huge, moderate-to-low-grade, strip-minable, high-cost copper field in the world, in Afghanistan, for $billions over the western bids. There will be others, but rest assured: They will be lower grade, higher cost, and the competition will be more intense. When was the last time you bought a “copper” fitting at the hardware store. They’re crap. The alloys are crap. Because the ore quality is in decline and the costs of extraction are rising. Same with oil, trees, tin, coal....Make no mistake: The war for the dwindling materials and energy flow is well underway.

No comments:

Post a Comment