Bank Runs, Bank Holidays, and Other Financial Stall Tactics

Bank Holidays Disguised as Computer Glitches in the UK.

NatWest glitch goes on: Bank to open on Sunday as millions of customers are still unable to get access to money

- NatWest have resolved the 'underlying problem'

- They are opening banks on Sunday and they will stay open until 7pm tonight

- Problems are expected to continue into NEXT WEEK as they deal with the backlog of payments

- House buyers unable to complete purchases because of glitch

- Customers STILL reporting that salaries are not being paid in and payments are not being made

- Up to 12MILLION customers are being affected by the problem

- NatWest say the problem was NOT caused by hacking

- Banks under obligation to put customer in the position they would have been if the problem had not happened

Read more: http://www.dailymail.co.uk/news/article-2162630/NatWest-problems-Online-banking-glitch-goes-affecting-millions-customers.html#ixzz1yXkpGy4Z

IRS Stalls Tax Refunds with System Upgrade Project

Federal tax refunds delayed by IRS system upgrade

Some people who filed their 2011 tax returns electronically between Jan. 17 and 25 will get their federal tax refunds about a week later than initial projections because of an Internal Revenue Service computer-system upgrade.

In a statement, the IRS said the delay “relates to fine-tuning IRS systems to adjust for new safeguards put in place this tax season to provide stronger protection against refund fraud.”

Tax preparers tell me they were originally notified the refund delay would only affect people who filed electronically on Jan. 17 or 18 and chose to have a refund deposited into a bank account.

But news reports quoted IRS officials saying the problem affected returns e-filed before Jan. 26. IRS spokesman Jesse Weller would only say that “Taxpayers who file on or after January 26 should not experience a delay.”

One tax preparer said her clients who filed Jan. 17 (the first day the IRS accepted e-filed returns) were originally told to expect a refund Jan. 25. Now they are being told it should come Feb. 8.

She notes that many people who file their returns on the earliest dates possible have simple returns and are desperate for their refund.

She notes that many people who file their returns on the earliest dates possible have simple returns and are desperate for their refund.

The IRS would not say how many returns filed before Jan. 26 will be affected. It said, “When the IRS announced the opening of the 2012 filing season, it advised taxpayers who electronically file and select direct deposit that they could see their refunds in as few as 10 days and 90 percent of refunds are provided within 21 days. Some taxpayers are getting refunds much faster, but at this time taxpayers should expect refunds to be issued as indicated in the original IRS guidelines.”

It also apologized “for any inconvenience caused by the revised refund dates.”

Taxpayers can track the status of their refund here.

Bank Runs in Greece Resemble 1929 Black Thursday

Police Urging Greeks To Stop Stuffing Mattresses

We have spent a considerable amount of time in the last week or two explaining just why depositor withdrawals (or bank runs) are the death knell for the Euro experiment. We first described the 'run on banks and governments' on the basis of the potential for overnight loss of 'fungibility'back in December but the escalation last week in Greece (and the contagion to Spain's Bankia) signals things are shifting to 11 on the amplifier of Euro-Fail. This evening brings new information from The Guardian that 'Police are urging Greeks to keep their money in bank accounts rather than putting it at risk of theft, amid further uncertainty about whether the austerity-struck country will remain in the eurozone.'

Greece's national police spokesman, Thanassis Kokkalakis, told Reuters:

"Many people have withdrawn their money from the banks fearing a financial crash, and they either carry it on them, find a hideout at home or in storage rooms. We urge people to trust the banking system, leave their money there, or at least in a safe place, not hide it at home."

Uhm, does anyone remember Cramer and his 'Bear Stearns' call? Or are we just "being silly?"

Speculation of a Euro-wide deposit guarantee scheme was quashed somewhat by yesterday's dismally predictable non-event summit - especially given the only three-week span to the next elections. That leaves Greek citizens juggling the possibility of having their home robbed against the probability that the government, via GEURO-isation, will do it for them in the bank.

More on the Boom Bust Cycle and the 1929 Stock Market Crash

Wall Street Crash of 1929

From Wikipedia, the free encyclopedia

"Black Tuesday" redirects here. For other uses, see Black Tuesday (disambiguation).

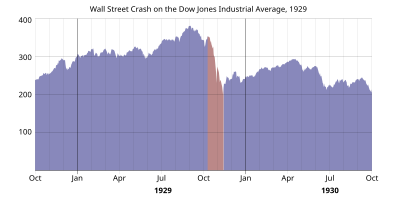

The Wall Street Crash of 1929, also known as the Great Crash and the Stock Market Crash of 1929, began in late October 1929 and was the most devastating stock market crash in thehistory of the United States when taking into consideration the full extent and duration of its fallout.[1] The crash signaled the beginning of the 10-year Great Depression that affected all Western industrialized countries[2] and did not end in the United States until the onset of American mobilization for World War II at the end of 1941.

Anyone who bought stocks in mid-1929 and held onto them saw most of his or her adult life pass by before getting back to even.

Contents[hide] |

[edit]Timeline

The Roaring Twenties, the decade that led up to the Crash,[4] was a time of wealth and excess. Despite the dangers of speculation, many believed that the stock market would continue to rise indefinitely. The market had been on a six-year run that saw the Dow Jones Industrial Average increase in value fivefold, peaking at 381.17 on September 3, 1929.[5] Shortly before the crash, economist Irving Fisher famously proclaimed, "Stock prices have reached what looks like a permanently high plateau."[6] The optimism and financial gains of the great bull market were shaken on "Black Thursday", October 24, 1929, when share prices on the New York Stock Exchange (NYSE) abruptly fell.

In the days leading up to the crash, the market was severely unstable. Periods of selling and high volumes of trading were interspersed with brief periods of rising prices and recovery. Economist and author Jude Wanniski later correlated these swings with the prospects for passage of the Smoot–Hawley Tariff Act, which was then being debated in Congress.[7]

On October 24 ("Black Thursday"), the market lost 11% of its value at the opening bell on very heavy trading. Several leading Wall Street bankers met to find a solution to the panic and chaos on the trading floor.[8] The meeting included Thomas W. Lamont, acting head of Morgan Bank; Albert Wiggin, head of the Chase National Bank; and Charles E. Mitchell, president of the National City Bank of New York. They chose Richard Whitney, vice president of the Exchange, to act on their behalf.