This article just about sums up what I was thinking.

“Facts do not cease to exist because they are ignored.” – Aldous Huxley Six months ago I wrote an article called

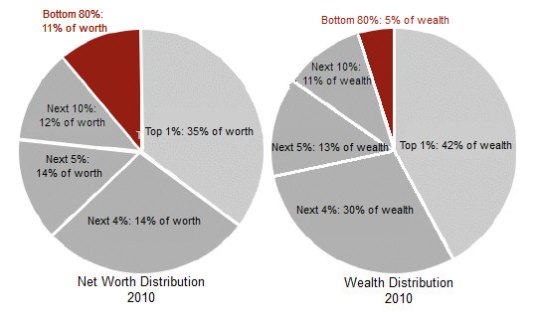

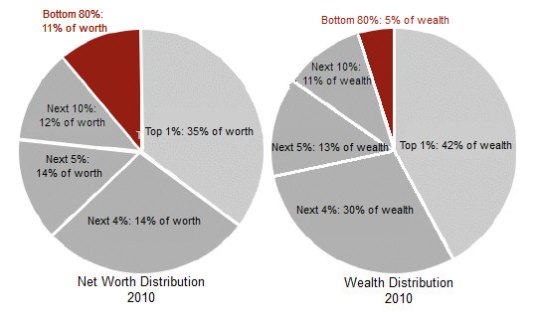

Are You Seeing What I’m Seeing? , describing my observations while traveling along Ridge Pike in Montgomery County, PA and motoring to my local Lowes store on a Saturday. My observations were in conflict with the storyline portrayed by the mainstream media pundits, Ivy League PhD economists, Washington politicians, and Wall Street shills. It is clear now that I must have been wrong. No more proof is needed than the fact the Dow has gone up 1,500 points, or 11%, since I wrote the article. Everyone knows the stock market reflects the true health of the nation – multi-millionaire Jim Cramer and his millionaire CNBC talking head cohorts tell me so. Ignore the fact that the bottom 80% only own 5% of the financial assets in this country and are not benefitted by the stock market in any way.

The mainstream corporate media that is dominated by six mega-corporations (Time Warner, Disney, Murdoch’s News Corporation, Comcast, Viacom, and Bertelsmann), has one purpose as described by the master of propaganda –

Edward Bernays :

“The conscious and intelligent manipulation of the organized habits and opinions of the masses is an important element in democratic society. Those who manipulate this unseen mechanism of society constitute an invisible government which is the true ruling power of our country. …We are governed, our minds are molded, our tastes formed, our ideas suggested, largely by men we have never heard of. This is a logical result of the way in which our democratic society is organized. Vast numbers of human beings must cooperate in this manner if they are to live together as a smoothly functioning society. …In almost every act of our daily lives, whether in the sphere of politics or business, in our social conduct or our ethical thinking, we are dominated by the relatively small number of persons…who understand the mental processes and social patterns of the masses. It is they who pull the wires which control the public mind.

These media corporations’ task is to use propaganda and misinformation to protect the interests of the status quo. The ruling class has the power to manipulate public opinion, obscure the truth, alter government data, and outright lie, but they can’t control the facts and reality smacking the average person in the face every day. Based on the performance of the stock market and the storyline of economic recovery being peddled by the corporate media, the facts must surely support their contention. Here are a few facts about what has really happened in the last six months since I wrote my article:

- The working age population has grown by 1.1 million, the number of employed Americans is up 500k, while the number of people who have left the labor force has gone up by 600k. The BLS reports the unemployment rate has fallen without blinking an eye or turning red with embarrassment.

- The number of Americans entering the Food Stamp Program in the last six months totaled 1 million, bringing the total to 47.8 million, or 20% of all households (up 15 million since the Obama economic recovery began in December 2009).

- Existing home sales have increased by a scintillating 2.9% on a seasonally adjusted annual basis and average prices have fallen by 6% in the last six months. It is surely a great sign that 32% of all home sales are to Wall Street investors and 25% are either foreclosure sales or short sales. A large percentage of the remaining sales are funded by 3% down FHA government backed loans.

- There were 31,000 new homes sales in January versus 34,000 new home sales six months prior. Through the magic of seasonal adjustment, this translates into a 15% increase.

- Single family housing starts were 41,600 in February versus 51,400 six months prior. Even using seasonal adjustments, the government drones can only report a pathetic 4.7% annualized increase and flat starts over the last three months, with mortgage rates at all-time lows.

- The National Debt has gone up by $750 billion in the last six months, while Real GDP has gone up by less than $150 billion.

- Real hourly earnings have not increased in the last six months.

- Consumer debt has risen by $65 billion as the Federal Government has doled out student loans like candy and auto loans (through the 80% government owned Ally Financial – aka GMAC, aka Ditech, aka ResCap) like crack dealer in West Philly.

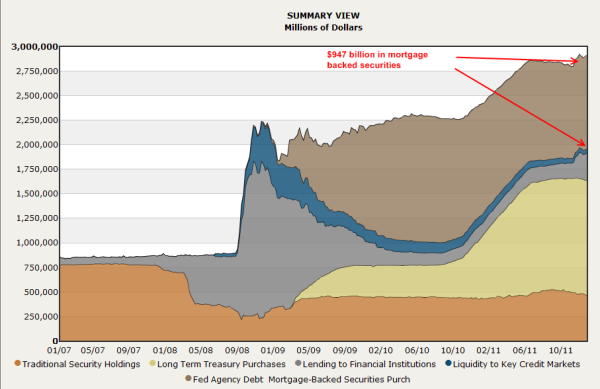

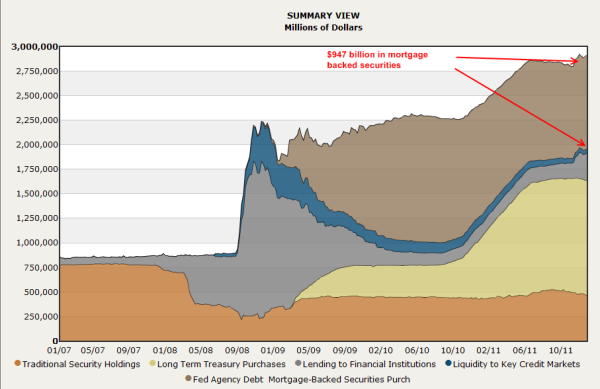

- The Federal Reserve has increased their balance sheet by $385 billion in the last six months by buying toxic mortgages from Wall Street banks and the majority of Treasuries issued by the government to fund the $1 trillion annual deficits being produced by the Obama administration. It now totals $3.2 trillion, up from $900 billion in September 2008, and headed to $4 trillion before this year is out.

- Retail sales have increased by less than 2% over the last six months and are barely 1% above last February. On an inflation adjusted basis, retail sales are falling. Other than internet sales and government financed auto sales, every other retail category is negative year over year. This is reflected in the poor sales and earnings reports from JC Penney, Sears, Best Buy, Wal-Mart, Target, Lowes, Kohl’s, Darden, McDonalds, and Yum Brands. I’m sure next quarter will be gangbusters, with the Obama payroll tax increase, Obamacare premium increases, 15% surge in gasoline prices, and continued inflation in food and energy.

Considering that 71% of GDP is dependent upon consumer spending (versus 62% in 1979 before the financialization of America), the dreadful results of retailers and restaurants even before the Obama tax increases confirms the country has been in recession since the second half of 2012. In 1979 the economy was still driven by domestic investment that accounted for 19% of GDP. Today, it wallows at all-time lows of 13%. In addition, our trade deficits, driven by debt fueled consumption, subtract 3.5% from GDP. These facts are reflected in the depressed outlook of small business owners who are the backbone of growth, hiring and entrepreneurship in this country. Small businesses of 500 employees or less employ half of all the private industry workers in the country and account for 65% of all new jobs created. There are approximately 27 million small businesses versus 18,000 large businesses. The chart below does not paint an improving picture. The small business optimism has dropped from an already low 92.8 in September 2012 to 90.8 in March 2013.

The head of the NFIB couldn’t make the situation any clearer:

“While the Fortune 500 is enjoying record high earnings, Main Street earnings remain depressed. Far more firms report sales down quarter over quarter than up. Washington is manufacturing one crisis after another—the debt ceiling, the fiscal cliff and the Sequester. Spreading fear and instability are certainly not a strategy to encourage investment and entrepreneurship. Three-quarters of small-business owners think that business conditions will be the same or worse in six months. Until owners’ forecast for the economy improves substantially, there will be little boost to hiring and spending from the small business half of the economy.” – NFIB chief economist Bill Dunkelberg

If consumers, who account for 71% of the economy, aren’t spending, and small business owners, who do 65% of all the hiring in the country, are petrified with insecurity, why is the stock market hitting all-time highs and the corporate media proclaiming happy days are here again? It can be explained by the distribution of wealth and income in this country. Every media pundit, politician, Wall Street shill, Ivy League PhD economist, and corporate titan you see on CNBC, Fox or any corporate media outlet is 1%er or better. The chart below shows the bottom 99% saw their real incomes decline between 2009 and 2011, while the top 1% reaped the stock market gains and corporate bonuses for using “creative” accounting to generate record corporate profits. The trend in 2012 through today has only widened this gap, as real worker wages have continued to decline and the stock market has advanced another 20%.

The feudal financial industry lords are feasting on caviar and champagne in their mountaintop manors while the serfs and peasants scrounge in the gutters for scraps and morsels. This path has been chosen by the king (Obama) and enabled by his court jester (Bernanke). Money printing and inflation are their weapons of choice. We are living in a 21st Century version of the Dark Ages.

On the Road Again

I’ve been baffled by a visible disconnect between deteriorating data and the storyline being sold to the ignorant masses by the financial elitists that run the show. The websites and truthful analysts that I respect and trust (

Zero Hedge ,

Mish ,

Jesse ,

Karl Denninger ,

John Hussman ,

David Stockman ,

Financial Sense and a few others) provide analytical evidence on a daily basis that confirm my view that our economic situation is worsening. We are all looking at the same data, but the pliable faux journalists that toil for their corporate masters spin the data in a manner designed to mislead and manipulate in order to mold public opinion, as Edward Bernays taught the invisible ruling class. As you can see, numbers and statistical data can be spun, adjusted, and manipulated to tell whatever story you want to depict. I prefer to confirm or deny my assessment with my observations out in the real world. I spend 12 hours per week cruising the highways and byways of Montgomery County and Philadelphia as I commute to and from work and shuttle my kids to guitar lessons, friends’ houses, and local malls. I can’t help but have my antenna attuned to what I’m seeing with my own eyes.

As I detailed in my previous article, Montgomery County is relatively affluent area with the dangerous urban enclaves of Norristown and Pottstown as the only blighted low income, high crime areas in the 500 square mile county of 800,000 people. The median household income and median home prices are 50% above the national averages. Major industries include healthcare, pharmaceuticals, insurance and information technology. It is one of only 30 counties in the country with a AAA rating from Standard & Poors (as if that means anything). On paper, my county appears to be thriving and healthy, with white collar professionals living an idyllic suburban existence. One small problem – the visual evidence as you travel along Welsh Road towards Montgomeryville or Germantown Pike towards Plymouth Meeting reveals a decaying infrastructure, dying retail meccas, and miles of empty office complexes.

I don’t think my general observations as I drive around Montgomery County are colored by any predisposition towards negativity. I see a gray winter like pallor has settled upon the land. I see termite pocked wooden fences with broken and missing slats. I see sagging porches. I see leaky roofs with missing tiles. I see vacant dilapidated hovels. I see mold tainted deteriorating siding on occupied houses. I see weed infested overgrown yards. I see collapsing barns and crumbling farm silos. I see houses and office buildings that haven’t been painted in 20 years. I see clock towers in strip malls with the wrong time. I see shuttered gas stations. I see retail stores with lights out in their signs. I see trees which fell during Hurricane Sandy five months ago still sitting in yards untouched. I see potholes not being filled. I see disintegrating highway overpasses and bridges. I constantly see emergency repairs on burst water mains. I see malfunctioning stoplights. I see fading traffic signage. I see regional malls with rust stained walls beneath their massive unlit Macys, JC Penney and Sears logos. I see hundreds of Space Available, For Lease, For Rent, Vacancy, For Sale and Store Closing signs dotting the suburban landscape. These sights are in a relatively affluent suburban county. When I reach West Philly, it looks more like Dresden in 1945.

Dresden – 1945 Philadelphia – 2013

I moved to my community in 1995 when the economy was plodding along at a 2.5% growth rate. The housing market was still depressed from the early 90s recession. The retail strip centers and larger malls in my area were 100% occupied. Office parks were bustling with activity. Office vacancy rates were the lowest in twenty years during the late 1990s. National GDP has grown by 112% (only 50% after adjusting for inflation) since 1995, with personal consumption rising 122%. Domestic investment has only grown by 80%, but imports skyrocketed by 204%. If the economy has more than doubled in the last 18 years, how could retail strip centers in my affluent community have 40% to 70% vacancy rates and office parks sit vacant for years? The answer is that Real GDP has not even advanced by 50%. Using a true rate of inflation, not the bastardized, manipulated, tortured BLS version, shows the country has essentially been in contraction since the year 2000.

The official government sanctioned data does not match what I see on the ground, but the

Shadowstats version of the data explains it perfectly.

My observations also don’t match up with the data reported by the likes of Reis, Trepp, Moody’s and the Federal Reserve. Reis reports a national vacancy rate of 17.1% for offices, barely below its peak of 17.6% in late 2010. Vacancy rates are 35% above 2007 levels and more than double the rates in the late 1990s. But what I realized after digging into the methodology of these reported figures is the true rates are significantly higher. First you must understand that Reis and Trepp are real estate companies who are in business to make money from commercial real estate transactions. It is in their self -interest to report data in the most positive manner possible – they’ve learned the lessons of Bernays. These mouthpieces for their industry slice and dice the numbers according to major markets, minor markets, suburban versus major cities, and most importantly they only measure Class A office space.

I didn’t realize the distinctions between classes when it comes to office space. The Building Owners and Managers Association describes the classes:

Class A office buildings have the “most prestigious buildings competing for premier office users with rents above average for the area.” Class A facilities have “high quality standard finishes, state of the art systems, exceptional accessibility and a definite market presence.” Class B office buildings as those that compete “for a wide range of users with rents in the average range for the area.” Class B buildings have “adequate systems” and finishes that “are fair to good for the area,” but that the buildings do not compete with Class A buildings for the same prices. Class C buildings are aimed towards “tenants requiring functional space at rents below the average for the area.”

So we have landlords self-reporting Class A vacancy rates in big markets to a real estate company that reports them without verification. Is it in a landlord’s best interest to under-report their vacancy rate? You bet it is. If potential tenants knew the true vacancy rates, they would be able to negotiate much lower rents. There is a beautiful Class A 77,000 square foot building near my house that was built in 2004. Nine years later there is still a huge Space Available sign in front of the building and it appears at least 50% vacant.

I pass another Class A property on Welsh Road called the Gwynedd Corporate Center that consists of three 40,000 square foot buildings in a 13 acre office park. It was built in 1998 and is completely dark. The vacancy rate is 100%. As I traveled down Germantown Pike last week I noted dozens of Class A office complexes with Space Available signs in front. I’m absolutely certain that vacancy rates in Class A offices in Montgomery County exceed 25%. When you expand your horizon to Class B and Class C office space, vacancy rates exceed 50%. The only booming business in my suburban paradise is Space Available sign manufacturing. We probably import those from China too. Despite the spin put on the data by the real estate industry, Moody’s reported data supports my estimates:

- The values of suburban offices in non-major markets are 43% below 2007 levels.

- Industrial property values in non-major markets are 28% below 2007 levels.

- Retail property values in non-major markets are 35% below 2007 levels.

The data being reported by Reis regarding vacancies in strip malls and regional malls is also highly questionable, based on my real world observations. The reported vacancy rates of 8.6% for regional malls and 10.7% for strip malls, barely below their 2011 peaks, are laughable. Again, there is no benefit for a landlord to report their true vacancy rate. The truth will depress rents further. This data is gathered by surveying developers and landlords. We all know how reputable and above board real estate professionals are – aka David Lereah, Larry Yun. A large strip mall near my house has a 70% vacancy rate, with another, one mile away, with a 50% vacancy rate. Anyone with two eyes and functioning brain that has visited a mall or driven past a strip mall knows that vacancy rates are at least 15%, the highest in U.S. history. These statistics don’t even capture the small pizza joints, craft shops, antique outlets, candy stores, book stores, gas stations and myriad of other family run small businesses that have been forced to close up shop in the last five years.

The disconnect between reality, the data reported by the mouthpieces of the status quo, and financial markets is as wide as the Grand Canyon. Even the purveyors of false data can’t get their stories straight. Trepp has been reporting steadily declining commercial delinquency rates since July 2012, when they had reached 10.34%, the highest level since the early 1990s. The decline is being driven solely by apartment complexes and hotels. Industrial and retail delinquencies continue to rise and office delinquencies are flat over the last three months. Again, the definition of delinquent is in the eye of the beholder.

The quarterly delinquency rates on commercial loans reported by the Federal Reserve is less than half the rate being reported by Trepp, at 4.13%. Bennie and his band of Ivy League MBA economists have reported 10 consecutive quarters of declining commercial loan delinquency rates. This is in direct contrast to the data reported by Trepp that showed delinquencies rising during 2012.

| | Real estate loans |

| All | Booked in domestic offices |

| Residential1 | Commercial2 | Farmland |

| 2012:4 | 7.57 | 10.07 | 4.13 | 2.67 |

| 2011:4 | 8.48 | 10.34 | 6.11 | 3.26 |

| 2010:4 | 9.12 | 10.23 | 7.96 | 3.59 |

| 2009:4 | 9.59 | 10.54 | 8.73 | 3.42 |

| 2008:4 | 6.04 | 6.67 | 5.49 | 2.28 |

| 2007:4 | 2.91 | 3.08 | 2.75 | 1.51 |

| 2006:4 | 1.70 | 1.95 | 1.32 | 1.41 |

The data being reported doesn’t pass the smell test. Commercial vacancy rates are at or above the levels seen during the last Wall Street created real estate crisis in the early 1990’s. During 1991/1992 commercial loan delinquency rates ranged between 10% and 12%. Today, with the same or higher levels of vacancy, the Federal Reserve reports 4% delinquency rates. When the latest Wall Street created financial collapse struck in 2008 and commercial property values crashed while vacancy rates soared, there were dire predictions of huge loan losses between 2010 and 2012. Commercial real estate loans generally rollover every 5 to 7 years. The massive issuance of dodgy subprime commercial loans between 2005 and 2007 would come due between 2010 and 2012. But miraculously delinquency rates have supposedly plunged from 8.78% in mid-2010 to 4.13% today. The Federal Reserve decided in 2009 to look the other way when assessing whether a real estate loan would ever be repaid. A loan isn’t considered delinquent if the lender decides it isn’t delinquent. The can’t miss strategy of extend, pretend and pray was implemented across the country as mandated by the Federal Reserve. This pushed out the surge in loan maturities to 2014 – 2016.

In an economic system that rewarded good choices and punished those who took ridiculous undue risks and lost, real estate developers, mall owners, and office landlords would be going bankrupt in large numbers and loan losses for Wall Street Too Stupid to Succeed banks would be in the billions. Developers took out loans in the mid-2000’s which were due to be refinanced in 2012. The property is worth 35% less and the rental income with a 20% vacancy rate isn’t enough to cover the interest payments on the loan. The borrower would have no option but to come up with 35% more cash and accept a higher interest rate because the risk of default had risen, or default. Instead, the lenders have pretended the value of the property hasn’t declined and they’ve extended the term of the loan at a lower interest rate. This was done on the instructions of the Federal Reserve, their regulator. The plan is dependent on an improvement in the office and retail markets. It seems the best laid plans of corrupt sycophant central bankers are going to fail.

Eyes Wide Open

There are 1,300 regional malls in this country, with most anchored by a JC Penney, Sears, Barnes & Noble, or Best Buy. The combination of declining real household income, aging population, lackluster employment growth, rising energy, food and healthcare costs, mounting tax burdens, and escalating on-line purchasing will result in the creation of 200 or more ghost malls over the next five years. The closure of thousands of big box stores is baked in the cake. The American people have run out of money. They have no equity left in their houses to tap. The average worker has only $25,000 of retirement savings and they are taking loans against it to make the mortgage payment and put food on the table. They can’t afford to perform normal maintenance on their property and are one emergency away from bankruptcy. In a true cycle of doom, most of the jobs “created” since 2009 are low skill retail jobs with little or no benefits. As storefronts go dark and more “Available” signs are erected in front of these weed infested eyesores, more Americans will lose their jobs and be unable to do their 71% part in our economic Ponzi scheme.

The reason office buildings across the land sit vacant, with mold and mildew silently working its magic behind the walls and under the carpets, is because small businesses are closing up shop and only a crazy person would attempt to start a new business in this warped economic environment of debt dependent diminishing returns. The 27 million small businesses in the country are fighting a losing battle against overbearing government regulations, increasingly heavy tax burdens, operating cost inflation, Obamacare mandates, a low skill poorly educated workforce, and customers with diminishing resources and declining disposable income. Small business owners are not optimistic about the future because they don’t have a sugar daddy like Bernanke to provide them with free money and a promise to bail them out if their high risk investments go bad. With small businesses accounting for 65% of all new hiring in this country and looming healthcare taxes, mandates, regulations and penalties approaching like a freight train, there is absolutely zero probability that office buildings will be filling up with new employees in the next few years. With hundreds of billions in commercial real estate loans coming due over the next three years, over 60% of the loans in the office and retail category, vacancy rates at record levels, and property values still 30% to 40% below the original loan values, a rendezvous with reality awaits. How long can bankers pretend to be paid on loans by developers who pretend they are collecting rent from non-existent tenants who are selling goods to non-existent customers? The implosion in the commercial real estate market will also blow a gaping hole in the Federal Reserve balance sheet, which is leveraged 55 to 1.

I regularly drive along Schoolhouse Road in Souderton. It is a winding country road with dozens of small manufacturing, warehousing, IT, aerospace, auto repair, bus transportation, retail and landscaping businesses operating and trying to scratch out a small profit. Most of these businesses have been operating for decades. I would estimate that most have annual revenue of less than $2 million and less than 100 employees. It is visibly evident they have not been thriving, as their facilities are looking increasingly worn down and in disrepair. Their access to credit has been reduced since the 2008 crisis, as only the Wall Street banks and mega-corporations with Washington lobbyists received Bennie Bucks and Obama stimulus pork. These small businesses have been operating on razor thin margins and unable to invest in their existing facilities or expand their businesses. The tax increases just foisted upon small business owners and their employees, along with Obamacare mandates which will drive healthcare costs dramatically higher, and waning demand due to lack of income, will surely push some of these businesses over the edge. There will be some harsh lessons learned on Schoolhouse Road over the next few years. I expect to see more of these signs along Schoolhouse Road and thousands of other roads in the next few years.

The mainstream media pawns, posing as journalists, have not only gotten the facts wrong regarding the current situation, but their myopia extends into the near future. The perpetual optimists that always see a pot of gold at the end of the rainbow are either willfully ignorant or a product of our government run public education system and can’t perform basic mathematical computations. As pointed out previously, consumer spending drives 71% of our economy. As would be expected, the highest level of annual spending occurs between the ages of 35 to 54 years old when people are in their peak earnings years. Young people are already burdened with $1 trillion of government peddled student loan debt and are defaulting at a 20% rate because there are no decent jobs available. Millions of Boomers are saddled with underwater mortgages, prodigious levels of credit card and auto loan debt, with retirement savings of $25,000 or less. Anyone expecting the young or old to ramp up spending over the next decade must be a CNBC pundit, University of Phoenix MBA graduate or Ivy League trained economist.

There will be 10,000 Boomers per day turning 65 years old for the next 18 years. Consumers in the 65-74 age segment spend 28% less on average than during their peak years. It is estimated that between 2010 and 2020 there will be approximately 14.5 million more consumers aged 65 or older. The number of Americans in their peak spending years will crash over the next decade. This surely bodes well for our suburban sprawl, mall based, cheap energy dependent, debt fueled society. Do you think this will lead to a revival in retail and office commercial real estate?

We’ve got $1 trillion annual deficits locked in for the next decade. We’ve got total credit market debt at 350% of GDP. We’ve got true unemployment exceeding 20%. We’ve had declining real wages for thirty years and no change in that trend. We’ve got an aging, savings poor, debt rich, obese, materialistic, iGadget distracted, proudly ignorant, delusional populace that prefer lies to truth and fantasy to reality. We’ve got 20% of households on food stamps. We’ve got food pantries, thrift stores and payday loan companies doing a booming business. We’ve got millions of people occupying underwater McMansions in picturesque suburban paradises that can’t make their mortgage payments or pay their utility bills, awaiting their imminent eviction notice from one of the Wall Street banks that created this societal catastrophe.

We’ve got a government further enslaving the middle class in student loan debt with the false hope of new jobs that aren’t being created. We’ve got a shadowy unaccountable organization, owned and controlled by the biggest banks in the world, that has run a Ponzi scheme called a fractional reserve lending system for 100 years, and inflated away 96% of the purchasing power of the U.S. dollar. We’ve got a self-proclaimed Ivy League academic expert on the Great Depression (created by the Federal Reserve) who has tripled the Federal Reserve balance sheet on his way to quadrupling it by year end, who has promised QE to eternity with the sole purpose of enriching his benefactors while impoverishing senior citizens and the middle class. He will ultimately be credited in history books as the creator of the Greater Depression that destroyed the worldwide financial system and resulted in death, destruction, chaos, starvation, mayhem and ultimately war on a grand scale. But in the meantime, he serves the purposes of the financial ruling class as a useful idiot and will continue to spew gibberish and propaganda to obscure their true agenda.

It is time to open your eyes and arise from your stupor. Observe what is happening around you. Look closely. Does the storyline match what you see in your ever day reality? It is them versus us. Whether you call them the invisible government, ruling class, financial overlords, oligarchs, the powers that be, ruling elite, or owners; there are powerful wealthy men who call the shots in this global criminal enterprise. Their names are Dimon, Corzine, Blankfein, Murdoch, Buffett, Soros, Bernanke, Obama, Romney, Bloomberg, Fink, among others. They are using every means at their disposal to retain their control and power over the worldwide economic system and gorge themselves like hyenas upon the carcasses of a crippled and dying middle class. They have nothing but contempt and scorn for the peasants. They’re your owners and consider you as their slaves. They don’t care about you. They think the commoners are unworthy to be in their presence. Time is growing short for these psychopathic criminals. No amount of propaganda can cover up the physical, economic, social, and psychological descent afflicting our world. There’s a bad moon rising and trouble is on the way. The time for hard choices is coming. The words of Edward Bernays represent the view of the ruling class, while the words of George Carlin represent the view of the working class.

“There’s a reason that education sucks, and it’s the same reason it will never ever be fixed. It’s never going to get any better, don’t look for it. Be happy with what you’ve got. Because the owners of this country don’t want that. I’m talking about the real owners now, the big, wealthy, business interests that control all things and make the big decisions. Forget the politicians, they’re irrelevant.

Politicians are put there to give you that idea that you have freedom of choice. You don’t. You have no choice. You have owners. They own you. They own everything. They own all the important land, they own and control the corporations, and they’ve long since bought and paid for the Senate, the Congress, the State Houses, and the City Halls. They’ve got the judges in their back pockets. And they own all the big media companies so they control just about all the news and information you get to hear. They’ve got you by the balls.

They spend billions of dollars every year lobbying to get what they want. Well, we know what they want; they want more for themselves and less for everybody else. But I’ll tell you what they don’t want—they don’t want a population of citizens capable of critical thinking. They don’t want well informed, well educated people capable of critical thinking. They’re not interested in that. That doesn’t help them. That’s against their interest. You know something, they don’t want people that are smart enough to sit around their kitchen table and figure out how badly they’re getting fucked by a system that threw them overboard 30 fucking years ago.” – George Carlin