Lecciones económicas # 1 - ¿Cómo funcionan los EE.UU. como una enorme deuda?

Esta es una pregunta tan obvia. Sin embargo, ¿cuántas personas en la CNBC, MSNBC, he contestado para usted? Le dejan suponer que los EE.UU. es un país tan increíblemente eficiente y trabajadora, que todo el mundo confía en nosotros para pagar esa deuda en algún punto en el futuro .... , ¿No? ¿Alguien? Bueller? (Día de Ferris Beuhler de descuento de referencia para nuestros lectores de fuera de Estados Unidos).

Es una historia larga y aburrida de la forma en que se convirtió en el mayor deudor del planeta. Yo haré todo lo posible para que sea comprensible y, posiblemente, incluso emocionante. Debido a la comprensión de este tema es el primer paso para su despertar, una vez que comprendes, la respuesta a la pregunta que hice anteriormente, que cambiará para siempre la forma de ver los Estados Unidos y la forma en que manejamos nuestras relaciones exteriores.

Recuerde que esta es una historia de alto nivel / lección de economía y no debe ser visto como una pieza académica. Tendré que el glaseado sobre algunas partes de la historia y hacer algunas analogías imperfectas. Pero al final, si usted tiene una mente inquisitiva, este artículo debe despertar el interés de investigar un poco más y seguir aprendiendo.

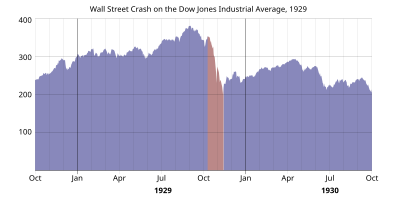

La historia de los Estados Unidos como la conocemos hoy comienza no es sorprendente que antes de la Gran Depresión. Se nos enseña que la Gran Depresión se inició el Lunes Negro de 28 de octubre 1929. También se nos enseñó que la Gran Depresión fue causada por la exuberancia irracional de los años 20 y el sistema se bloqueó como todo el mundo empezó a vender todo lo que, al mismo tiempo.

Esto es cierto hasta cierto punto. Pero es como decir que el avión se estrelló porque el aire dejó de fluir en la parte superior de las alas. Bueno, no la mierda el avión se estrelló porque no había corriente de aire. ¿POR QUÉ LA PARADA DEL AIRE CORRIENTE es la pregunta que usted realmente necesita saber la respuesta a, y es aquí donde vamos a comenzar nuestra lección sobre por qué Estados Unidos puede funcionar como una enorme deuda.

Voy a salvar a la Gran Depresión y el gran colapso deflacionario para otra lección. Me limitaré a dar algunos puntos de alto nivel que deben ser entendidos acerca de la década de 1920 y 1930. La cosa más importante a comprender acerca de pre-1920 de la economía mundial es que Gran Bretaña era el perro grande en el mundo. La libra esterlina británica era el mundo lo que el dólar de EE.UU. es en la actualidad. Gran Bretaña tuvo influencia en los mercados del mundo entero, su flota naval, y estaba en el centro de un sistema mundial que se extrae la riqueza del mundo, luego el tercero y se lo trajo a la isla su hogar. Sin embargo, hubo un problema de elaboración de la cerveza en Gran Bretaña como la década de 1920 comenzó. El Reino Unido se fue extendiendo demasiado en casi cada turno. Llevaban una enorme deuda que en el pasado nunca fue un problema.

En el pasado, Gran Bretaña sólo tenía que tirar de las naciones del mundo más terceros bajo su "protección" y que podrían extraer más riqueza para mantener su deuda bajo control. El juego que estaban jugando empezó a terminar en la década de 1920 como la gente empezó a cuestionar el sistema libra esterlina británica que estaba en el corazón del comercio internacional durante ese tiempo.

Una vez más, voy a saltar un poco de historia muy importante aquí para mantener la historia en movimiento. Sólo entiende que es el colapso del sistema Libra esterlina, lo que condujo directamente a la Gran Depresión y en última instancia, la Primera Guerra Mundial 2.

En el decenio de 1930 casi toda Europa se vio envuelto en una depresión masiva y hacia el final de la década, la guerra abierta. En los Estados Unidos, la década de 1930 vio a una depresión económica masiva de la talla de los que nuestro país nunca había visto. Nuestras lecciones de la historia del estado que Roosevelt salvó al país a través de sus programas milagrosos en el gasto público y su intervención non-stop en la economía de EE.UU.. La realidad era (como ahora) que casi todos los programas iniciados en la década de 1930 fracasó estrepitosamente. No fue hasta el 07 de diciembre 1941 que las cosas empezaron a cambiar para los Estados Unidos.

Volveré a este período de tiempo durante otra lección, ya que es merecedor de artículos probablemente varios. Sé que Franklin Delano Roosevelt es considerado por muchos como una figura más allá del reproche. Y en algunos niveles que estaba. Yo no quiero ir en detrimento de la lección aquí por empantanarse con los debates en torno a Franklin Delano Roosevelt, la depresión y la Segunda Guerra Mundial.

Vamos a parpadear adelante hacia el final de la guerra y 1944. Se hace evidente a los vencedores finales de la guerra (Francia, EE.UU. e Inglaterra) que si no se hace nada para evitarlo, y otra la depresión va a agarrar a medida que millones de hombres regresar a sus hogares a las fábricas que ya no son productores de tanques y aviones . Los aliados victoriosos en última instancia, se reunieron en un lugar llamado Bretton Woods, New Hampshire, donde se forjó el marco de un sistema monetario internacional para reemplazar el sistema fallido Inglés.

Desde que Estados Unidos era la economía más grande en este momento y tenía una base económica fuerte y profunda, se decidió que el dólar de EE.UU. podría actuar como moneda de reserva del mundo. Esto es más que importante a entender, ya que es este hecho crucial en que se basa toda nuestra existencia a este día.

¿Qué es una moneda de reserva?

Para poner esto en términos más fáciles de entender, vamos a utilizar tarjetas de comercio como un ejemplo. Digamos que tenemos a 10 personas diferentes que desean para el comercio. Tiene Pro Bowling cromos Tour, uno de los otros chicos tiene Pro cromos golfista y otro tipo tiene Pro cromos de hockey. Ahora nada en contra de las personas que comercian con este tipo de tarjetas, pero no son las cartas coleccionables más populares del mundo. Yo, en cambio otros tienen tarjetas de béisbol! Todo el mundo en el planeta si realmente gusta el béisbol o no, entender el valor de las tarjetas de béisbol de valor. Así que en este mundo en el que decide que mis tarjetas de béisbol será en el centro de nuestro sistema de comercio.

Todo es "denominado" (es decir, el precio se fija en esta moneda) en tarjetas de Bob COMERCIO DE BÉISBOL. Así que si usted quiere comprar gasolina para su coche, sus Pro Bowling cromos turísticos no son buenos. Usted tiene que cambiar por cromos de Bob en primer lugar. Con Bob cartas en la mano, entonces usted puede ir y comprar su gasolina.

El tipo de venta de la gasolina continuación, puede utilizar las tarjetas para comprar otras cosas, como tarjetas de béisbol de Bob son muy valiosos. O se puede simplemente sentarse en ellos y espero que seguir ganando en valor, lo que hacen desde hace décadas.

Así que sobre esto de nuevo al mundo real, ¿qué significa esto? Bueno, después de 1945 y el final de la guerra, los vencedores decide colocar el dólar de EE.UU. como moneda de reserva del mundo. Esto significa que todos los productos básicos como el petróleo y el trigo y la gasolina y el oro y la plata y todo lo demás se expresan principalmente en dólares estadounidenses.

Así que si usted es un país sin petróleo o gasolina, y usted está en necesidad de estas cosas, usted debe negociar. Llegados a este punto en el tiempo, los Estados Unidos fue de lejos el mayor productor de petróleo en el planeta. Los EE.UU. controla el precio internacional del petróleo. Sin importar si usted compró el aceite de los EE.UU. o el productor de petróleo en ciernes en el Oriente Medio, que ha adquirido de que el petróleo en dólares americanos. Así que si usted es francés y que está comprando petróleo de Arabia Saudita, la transacción debe hacerse en dólares estadounidenses. Esto significa que debes cambiar de francos (unidad monetaria de Francia ante el euro) de dólares estadounidenses.

Había mucho que entró en la determinación del valor relativo de una unidad monetaria los países y no voy a aburrir con los detalles de hoy. Baste decir que había un mercado que determina lo que vale la pena el Franco fue, en comparación con el dólar de EE.UU.. Así como una empresa francesa en la necesidad de petróleo, que intercambiaron francos para el USD (dólares estadounidenses) y ha adquirido su petróleo de Arabia Saudita. Ahora Arabia Saudita está sentado sobre un montón de dólares y que tienen necesidades muy pequeños, ya que somos un país un tanto simple. Tienen dos opciones. Ellos pueden gastar en lujosos palacios o la construcción de un militar o se puede guardar para un día lluvioso. Arabia Saudita, en esos días hicieron ambas cosas. Se compró equipo militar de EE.UU. para protegerse de sus vecinos y enviado de vuelta al dólar de los Estados Unidos y compraron bonos del Tesoro de Estados Unidos.

De cualquier manera, ese dinero terminó de vuelta en los Estados Unidos. El primer método ayudó a apuntalar a los traficantes de armas y los fabricantes en los Estados Unidos y cientos de miles de empleados de American en bien remunerados puestos de trabajo de contratos militares. El segundo método ayudó a Estados Unidos asumir una carga de la deuda casi permanente. Recuerde que los bonos del Tesoro de Estados Unidos no son más que la deuda de EE.UU. que se vende en el mercado. Los titulares de los bonos del Tesoro de Estados Unidos se les promete un modesto retorno de su dinero durante un período de años 1,3,5, 10 o 30. Los EE.UU. requebraja de hasta 1 mil millones de dólares en deuda y vende bonos del Tesoro en el mercado para ayudar a cubrir esa deuda. Sólo tiene que pago cuando el Tesoro madura. Arabia Saudita era conocido para comprar la deuda a largo plazo de EE.UU. en el rango de 30 años.

Esto significa que siempre que tenía confianza en la economía de EE.UU., que seguirá haciendo más dinero cuanto más tiempo mantenga su dinero en bonos del Tesoro de Estados Unidos. Y este fue el mismo para cualquier otra persona que celebró dólares estadounidenses. Recuerda que desde 1946 hasta finales de 1960, los Estados Unidos fue de lejos el mayor exportador de todo, desde automóviles y televisores, a los productos de granos y el petróleo.

Durante este periodo de tiempo, que era un beneficio neto de tener dólares estadounidenses en forma de bonos del Tesoro, ya que nuestra moneda era de lejos el más estable y pagado los mejores rendimientos. Y nuestras necesidades se convirtió en insaciable como la Guerra Fría batido una y otra vez. Desde el final de la Segunda Guerra Mundial, que tuvo el conflicto de Corea y la Guerra de Vietnam, que eran enorme déficit creación de eventos, pero también tuvimos innumerables conflictos más pequeños y las operaciones encubiertas que cuestan decenas de Estados Unidos miles de millones de dólares. TODO ESTO fue financiado por el sistema de reciclaje EE.UU. DÓLAR.

Podríamos incurrir en déficits enormes, ya que nuestra moneda se puede crear a voluntad mediante la creación de la deuda en forma de bonos del Tesoro de Estados Unidos. Estos tesoros fueron por lo general en la demanda como el dólar estadounidense se apilan en los bancos extranjeros, con nada más que hacer con ellos. Si ellos no estaban comprando bonos del Tesoro de Estados Unidos, que estaban comprando el hardware militar de EE.UU. o el número cada vez mayor de bienes de consumo como refrigeradores y lavadoras. El mundo entero la banca occidental (y todos sus subordinados en todo el mundo) se centró en la creación de deuda de EE.UU.. Es la lubricación que mantiene el consumo de rodadura y sigue.

Este sistema funcionó de maravilla a lo largo de las décadas de los años 1950 y 1960. No fue sino hasta la última parte de los años 60 y principios de los 70 que las grietas comenzaron a aparecer en la superficie de este "maravilloso" sistema. Al igual que el sistema de Inglés en la década de 1920, la gente comenzó a cuestionar la carga de la deuda de los Estados Unidos y la disminución de la destreza de nuestra base manufacturera. Fue en este momento que los EE.UU. también dejó de ser un exportador neto de petróleo.

La combinación de estos dos eventos (EE.UU. convertirse en una nación acreedora importar más de lo que exporta, y el hecho de que consumimos más petróleo del que produce) que llevó a un colapso del sistema de Bretton Woods en 1971. Fue provocada por Francia, y su renuencia a comprar bonos del Tesoro de Estados Unidos con sus repuestos dólares estadounidenses. Por el contrario, exigió el equivalente de oro de los dólares estadounidenses. Esto habría sido catastrófico si se hubiera permitido que ocurra. Debido a que no había forma dólares americanos demasiados a cabo en el sistema para ser todo lo convierte en oro. Y se temía que si Francia se le permitió cobrar de USD para el oro, que habría una avalancha de otros países hagan lo mismo.

En reacción a este pánico, el presidente Nixon cerró la ventana del oro llamada, lo que significa que los EE.UU. ya no es convertir a dólares por el oro en los mercados internacionales. Esto llevó a una crisis financiera que muchos temían que la cabeza del mundo en 1929 y la depresión en todo el mundo. Los líderes del mundo financiero se reunieron de nuevo en Bretton Woods, NH y elaboraron un nuevo acuerdo.

Este acuerdo es el que ha llevado a los Estados Unidos de algas de hasta un asombroso 16 billón de dólares de la deuda nacional (cerca de 70000 mil millones si se cuentan los pasivos no financiados, como el Seguro Social y las guerras sin fondos). Este acuerdo se denomina Los Acuerdos de Bretton Woods y se firmó el de casi todos los grandes (y pequeños) potencias económicas del mundo.

Es un sistema que ya no se basa en el oro como soporte para monedas internacionales. Es estrictamente un sistema de trabajo que enfrenta a una divisa contra otra, sobre la base de valor relativo según lo determinado por los mercados abiertos.

Pero hay algo que el mundo se olvidó. O, más probable es que no podía encontrar la manera de librarse de el agujero que se encontraban in Se olvidaron de que el dólar de EE.UU. sigue siendo denominados cada cosa de la pena en el planeta. El más grande de lo que era (y sigue siendo) de petróleo. En la década de 1970 fue la OPEP, que fue la determinación de los precios del petróleo en todo el mundo, y los Estados Unidos tuvo que llegar a una forma de mantener a estos pequeños países ricos en petróleo se hunda a los EE.UU. a otra Gran Depresión.

La respuesta fue RECICLAJE DE PETRO DÓLAR. Este es un término que yo estoy seguro que todos ustedes han oído hablar, pero tal vez no aprecian lo que significa. Si usted está familiarizado con el trabajo del Sr. Ruppert sobre estupefacientes, estoy seguro de que han oído el término de reciclaje Narco Dólar. Es el mismo concepto. A partir de mediados a finales de 1970 es los Estados Unidos hicieron acuerdos difíciles con Arabia Saudí y en esencia de acuerdo en que un ataque sobre el Oriente Medio era lo mismo que un ataque a los propios Estados Unidos. Conocido en última instancia, como la Doctrina Carter (anunciado oficialmente en 1980), se entendió que cualquier país que metido con Arabia Saudita o en cualquiera de los otros productores de petróleo importantes en el Golfo, se corría el riesgo de estar en el extremo receptor de los Estados Unidos el poderío militar.

A día de hoy, es lo que mantiene el acuerdo de Bretton Woods en el afecto. Desde la década de 1970 hasta el día de hoy, toda nuestra existencia está determinada por este acuerdo. Lo que esto significa partir de ese día, DÉFICIT EN LOS ESTADOS UNIDOS NO IMPORTA.

Le tomó casi la mitad de una década para que este acuerdo propio cemento y para las economías del mundo para comenzar a estabilizarse y, al final, tuvo la genialidad económica (la locura) de un grupo de hombres que rodeaba a un nuevo presidente en 1981 para aprovechar al máximo el poder del mundo se había dado a los Estados Unidos. Llegó a ser conocido como "la mañana en los Estados Unidos" o "economía vudú". Se dio cuenta por los responsables en los Estados Unidos que tenían las riendas de un dinero que nunca terminó de impresión de la máquina que, literalmente, podría continuar para siempre.

Si nos fijamos en cada carta única en relación con la deuda y el gasto en los Estados Unidos, que se vería una aceleración constante e interminable de la deuda y el gasto a partir de finales de 1970 y continúa hasta el momento en que escribió esta frase. El mundo dio a Estados Unidos carta blanca para gastar a su antojo ... ¿POR QUÉ? Porque no hay otra opción.

Si usted es Grecia y desea comprar petróleo de Kuwait, que aún debe hacerlo en dólares estadounidenses. Usted debe cambiar euros por dólares de Estados Unidos en primer lugar, comprar el petróleo de Kuwait y Kuwait tiene más o menos una de las dos opciones sobre qué hacer con esos dólares. O bien comprar hardware militar de EE.UU., o que compran los bonos del Tesoro de Estados Unidos.

Por lo tanto el apetito insaciable de petróleo en todo el mundo sólo fortalece los Estados Unidos con cada nueva transacción. Nos permite pasar más de un billón de dólares más que tomamos en cada año. Las cantidades son absolutamente irrelevantes sin embargo. Podríamos mover la barra a dos billones y el sistema todavía podría mantener el bombeo de distancia.

¿POR QUÉ? Debido a que en su corazón es la fuerza militar. Es por eso que invadió Irak después de 9/11, es por eso que amenazan con invadir a Irán. Es por eso que Islandia fue sancionado por dar la espalda en el sistema hace varios años, y es por eso que Grecia se ve obligada a comer austeridad en vez de hacer lo que está en su mejor interés y lanzar el euro por la borda y eludir su "responsabilidad".

Sin el mundo acepta dólares americanos como intermediario para el pago en el sistema económico mundial, los EE.UU. y por poder todo el mundo conectados EE.UU. caería en una depresión global completa y devastadora de la talla de los cuales nunca se han visto.

Esa es la apuesta que están jugando en contra y es por eso que está aquí. Es por eso que debe ser religiosamente trabajando para encontrar soluciones locales a los problemas que enfrentan usted y su comunidad. Porque al igual que el sistema británico de la década de 1920, el Sistema de EE.UU. va a fallar y cuando lo hace, hará que la Gran Depresión mirar manso. Y el desafortunado final para la mayoría de los sistemas monetarios globales es la guerra y la hambruna.

Si nos fijamos en la historia a través de la lente de la economía y los sistemas monetarios, verá que lo que estamos viviendo en estos momentos ha sucedido en innumerables ocasiones. Pero nunca en la escala mundial, estamos en peligro de ahora. Casi a la una, no es una guerra que se reúne al final de la desaparición de cualquier sistema monetario global o regional.

Se puede volver a ocurrir. Sólo que está en juego son mucho más altos ahora que incluso durante la Segunda Guerra Mundial. Ojalá esta lección podría terminar con una nota más feliz, pero la realidad es la realidad. Por otra parte, haciendo caso omiso de la historia puede ser fatal para la familia y los amigos (y de uno mismo), la mejor manera de comprender los desafíos y los peligros y seguir adelante con un plan que puede aislarse de lo peor de lo que puede venir a nuestra manera.

Perdón por la longitud de este post y si usted ha llegado hasta aquí, por favor, mándenme una nota de abajo y dime lo que piensas. Esta información me ayudará a construir mejores lecciones en el futuro.

The original article appeared in English on Collapsenet.