The hits keep on coming. Just last week, in the post, More Clinton Foundation Cronyism – The Deal to Sell Uranium Interests to Russia While Hillary was Secretary of State, I referred to the Clinton Foundation as “a veritable clearinghouse for cronyism masquerading as a charity.” Here’s the full opening paragraph to the piece:

If you looked at the U.S. economy under a microscope, what you’d see is a gigantic cancerous blob of cronyism surrounded by tech startups and huge prisons. If you zeroed in on the cancerous tumor, at the nucleus you’d see a network of crony institutions like the Federal Reserve, intelligence agencies, TBTF Wall Street banks and defense contractors. Pretty close to that, you’d probably find the Clinton Foundation. A veritable clearinghouse for cronyism masquerading as a charity.

Unsurprisingly, I’m not the only one who has come to such a conclusion. In a New York Post article from Sunday that is generating a lot of buzz, Bill Allison, a senior fellow at nonpartisan, nonprofit government watchdog group the Sunlight Foundation, is quoted saying:

It seems like the Clinton Foundation operates as a slush fund for the Clintons.

In case you’re wondering what might prompt Mr. Allison to make such a claim, it’s not just the recent pay-to-play scandals that have emerged. It appears that based on Clinton Foundation tax filings, very little of the charity’s donations are going to, well, charity. In fact, this so called “charity” is so shady, a charity watchdog recently put it on its “watch list” of problematic nonprofits. The New York Postreports:

The Clinton Foundation’s finances are so messy that the nation’s most influential charity watchdog put it on its “watch list” of problematic nonprofits last month.The Clinton family’s mega-charity took in more than $140 million in grants and pledges in 2013 but spent just $9 million on direct aid.The group spent the bulk of its windfall on administration, travel, and salaries and bonuses, with the fattest payouts going to family friends.On its 2013 tax forms, the most recent available, the foundation claimed it spent $30 million on payroll and employee benefits; $8.7 million in rent and office expenses; $9.2 million on “conferences, conventions and meetings”; $8 million on fundraising; and nearly $8.5 million on travel. None of the Clintons is on the payroll, but they do enjoy first-class flights paid for by the foundation.Charity Navigator, which rates nonprofits, recently refused to rate the Clinton Foundation because its “atypical business model . . . doesn’t meet our criteria.”Charity Navigator put the foundation on its “watch list,” which warns potential donors about investing in problematic charities. The 23 charities on the list include the Rev. Al Sharpton’s troubled National Action Network, which is cited for failing to pay payroll taxes for several years.

It was the Federalist which first broke the story about the Clinton Foundation spending more money on salaries and travel than grants. It reported the following back in March:

When anyone contributes to the Clinton Foundation, it actually goes toward fat salaries, administrative bloat, and lavish travel.Between 2009 and 2012, the Clinton Foundation raised over $500 million dollars according to a review of IRS documents by The Federalist (2012, 2011, 2010, 2009, 2008). A measly 15 percent of that, or $75 million, went towards programmatic grants. More than $25 million went to fund travel expenses. Nearly $110 million went toward employee salaries and benefits. And a whopping $290 million during that period — nearly 60 percent of all money raised — was classified merely as “other expenses.” Official IRS forms do not list cigar or dry-cleaning expenses as a specific line item. The Clinton Foundation may well be saving lives, but it seems odd that the costs of so many life-saving activities would be classified by the organization itself as just random, miscellaneous expenses.

Since then, the Clinton Foundation has tried to defend itself, but this is the Federalist’s response, published today:

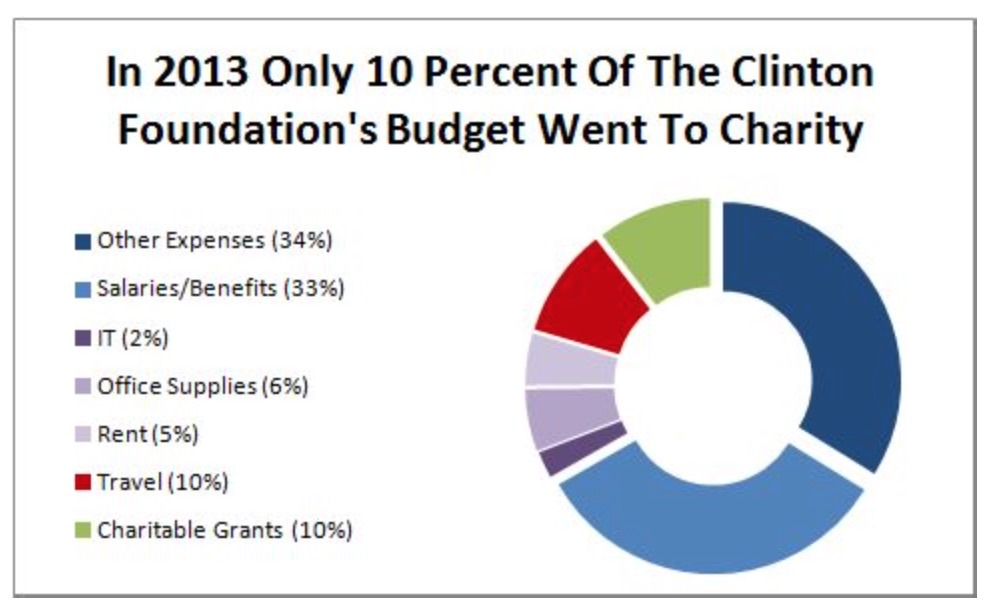

After a week of being attacked for shady bookkeeping and questionable expenditures, the Clinton Foundation is fighting back. In a tweet posted last week, the Clinton Foundation claimed that 88 percent of its expenditures went “directly to [the foundation’s] life-changing work.”There’s only one problem: that claim is demonstrably false. And it is false not according to some partisan spin on the numbers, but because the organization’s own tax filings contradict the claim.In order for the 88 percent claim to be even remotely close to the truth, the words “directly” and “life-changing” have to mean something other than “directly” and “life-changing.” For example, the Clinton Foundation spent nearly $8.5 million–10 percent of all 2013 expenditures–on travel. Do plane tickets and hotel accommodations directly change lives? Nearly $4.8 million–5.6 percent of all expenditures–was spent on office supplies. Are ink cartridges and staplers “life-changing” commodities?But what if those employees and those IT costs and those travel expenses indirectly save lives, you might ask. Sure, it’s overhead, but what if it’s overhead in the service of a larger mission? Fair question. Even using the broadest definition of “program expenses” possible, however, the 88 percent claim is still false. How do we know? Because the IRS 990 forms submitted by the Clinton Foundation include a specific and detailed accounting of these programmatic expenses. And even using extremely broad definitions–definitions that allow office supply, rent, travel, and IT costs to be counted as programmatic costs–the Clinton Foundation fails its own test.If you take a narrower, and more realistic, view of the tax-exempt group’s expenditures by excluding obvious overhead expenses and focusing on direct grants to charities and governments, the numbers look much worse. In 2013, for example, only 10 percent of the Clinton Foundation’s expenditures were for direct charitable grants. The amount it spent on charitable grants–$8.8 million–was dwarfed by the $17.2 million it cumulatively spent on travel, rent, and office supplies. Between 2011 and 2013, the organization spent only 9.9 percent of the $252 million it collected on direct charitable grants.While some may claim that the Clinton Foundation does its charity by itself, rather than outsourcing to other organizations in the form of grants, there appears to be little evidence of that activity in 2013. In 2008, for example, the Clinton Foundation spent nearly $100 million purchasing and distributing medicine and working with its care partners. In 2009, the organization spent $126 million on pharmaceutical and care partner expenses. By 2011, those activities were virtually non-existent. The group spent nothing on pharmaceutical expenses and only $1.2 million on care partner expenses. In 2012 and 2013, the Clinton Foundation spent $0. In just a few short years, the Clinton’s primary philanthropic project transitioned from a massive player in global pharmaceutical distribution to a bloated travel agency and conference organizing business that just happened to be tax-exempt.

Now here’s the money shot:

So are you ready?